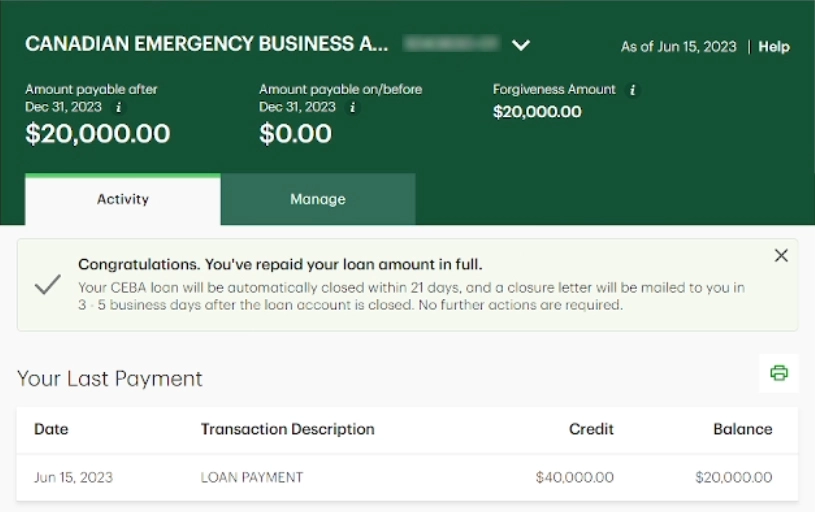

In this case, you’d be eligible for forgiveness of 25% on the first $40,000, and 50% on amounts between $40,000 and $60,000. So, for example, if you borrowed $60,000, here’s how you’d calculate your potential loan forgiveness: $40,000 x 0.25 = $10,000. $20,000 x 0.50 = $10,000. This calculation results in a total forgiveness amount of.. CEBA loans: repayment extension for some, notices of ineligibility for others. In October 2022, financial institutions began sending out notices to CEBA loan recipients confirming a new repayment deadline and advising others that they have been deemed ineligible for the loan in the first place. Many small business owners have called us to ask.

CEBA LOAN BUSINESS CLOSED THE 1 DRASTIC ULTIMATE CEBA LOAN PLAN Ira SmithTrustee

CEBA LOAN UPDATE 3 INTRIGUING CREATIVE WAYS FOR ENTREPRENEURS TO CONQUER CEBA LOAN DEFAULT

Gold Loan గోల్డ్ లోన్ తిరిగి చెల్లించకపోతే ఏమవుతుంది?.. పూర్తి వివరాలు మీ కోసం Telugu News

Small Businesses Push for CEBA Loan Repayment Extension World Today News

What Happens If You Can’t Pay Your CEBA Loan? Hoyes Michalos

What You Need To Know About CEBA Loan Repayments Act Fast? YouTube

CEBA Loan Updates Atmos Financial Services Inc.

How To Pay Off Home Loan Faster In Malaysia? Here’s 5 Ways To Do It!

తీసుకున్న అప్పు తిరిగి చెల్లించకపోతే ఏమవుతుంది?What happens if the loan is not repaid

Solved Question 9 (2 points) Since the 1980s union

CEBALoantaximplicationrules Lnsca

What Happens If You Don’t Repay Your CEBA Loan? ceba.ca

TorontoDominion Bank TD ceba.ca

When Does the CEBA Loan Need to be Repaid? ceba.ca

CEBA Repayments Due Soon to Enable Partial Loan Bateman MacKay

What Can the CEBA Loan Be Used For? ceba.ca

Government expands criteria of 40,000 small business CEBA loan program BetaKit

What happens if you can’t pay your CEBA loan? Spergel

Only a fraction of CEBA loans have been repaid as businesses call for deadline extension abcboyama

Petition · Extend the CEBA Loan Repayment Deadline to Dec 31,2025 Canada ·

There are some key dates that CEBA loan holders should be aware of: December 31, 2023: Deadline for full loan repayment for businesses not eligible for loan forgiveness (as previously informed by lenders). The January 18, 2024, extension below will not apply to you. January 18, 2024: Deadline for repayment to qualify for the interest-free grace.. Repayment terms of CEBA loans. Under the terms, repayment of the balance of the loan on or before December 31, 2023, will result in loan forgiveness of 33 percent (up to $20,000). The remaining amount is to be repaid by December 31, 2025. However, it’s essential to note that while the loan is interest-free until 2023, interest of 5% per annum.